Assess Your own Collateral

The loan-to-worth (LTV) proportion is how lenders assess the equity for how far you owe in your mortgage. On average, your LTV should be 80% or smaller. This means that you may have at least 20% collateral of your house. But people with lower credit scores may want to showcase higher guarantee.

Look at your Personal debt-to-Money Ratio

Their DTI ratio means the entire personal debt payments you create for each and every times due to the fact a portion of your own month-to-month earnings. Really loan providers see 43% DTI or less getting giving a property collateral mortgage, nevertheless should be below you to height when you have good bad credit rating. It includes lenders way more trust which you yourself can prioritize your loan repayments.

Loan providers wish to know that you are reliable, and achieving even more collateral of your property accelerates you to definitely confidence. However, getting prepared to address lenders’ concerns about a decreased credit rating is another good treatment for show that desire. End up being proactive in the delivering a page to explain your credit report, current rating, and you can steps you are taking to build your own borrowing.

Pertain Having Several Lenders

Looking around for a loan having several lenders was a smart circulate, no matter your credit score. For each bank get additional fine print, eg annual percentage rate (APR), you’ll be able to prepayment punishment, and you may borrowing insurance rates demands. Implement with many different lenders you believe and get her or him participate for your organization for more good conditions.

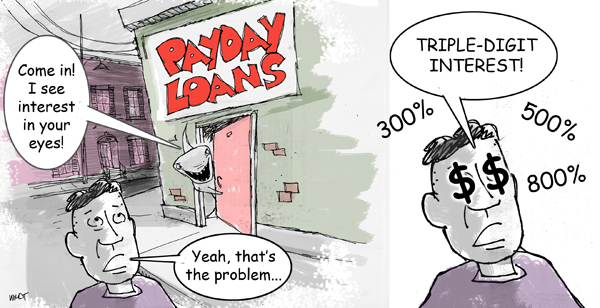

Consider shady loan providers. Specific will get create certain terminology below that they learn possible default. Look out for loan providers who require you to definitely indication blank documents, changes lay terms, otherwise push one indication rather than returning to loans Natural Bridge an entire remark.

Choices to Home Guarantee Financing to possess Borrowers Which have Less than perfect credit

You may find one taking out a property guarantee loan isn’t really a knowledgeable suggestion with a dismal credit score. There are other choices to consider according to debt mentality:

- HELOC: A property guarantee line of credit (HELOC) acts including a charge card shielded by the home. You could potentially obtain as frequently money as you need inside the mark several months. Costs was varying, but you pay just for what your acquire.

- Signature loans: Signature loans is unsecured and will be used regarding objective. This type of tend to include less positive terms, like large APRs based on credit scores. You will want to nevertheless shop around so you’re able to contend with their weakened rating.

- Cash-away refinance: It pays off your first financial with a new, huge mortgage with assorted terms and you will timelines. The level of your residence equity decreases, nevertheless could find it easier to come across a lender you to definitely carry out undertake a reduced credit score in this situation.

- Contrary financial: An opposite financial turns more mature owners’ house guarantee towards the repayments regarding lenders which can be, essentially, buying your possession.

The conclusion

Property equity loan is a great option for a monetary raise to cover crisis costs, undertaking a corporate, otherwise carrying out a property repair. Having poor credit doesn’t necessarily deny you which opportunity however, get ready to spend a higher level, hold alot more security of your house, and keep working harder in order to encourage lenders that you are a good chance.

You could stop this new process if you’re not happier towards the financing alternatives you can get with your credit score. Make sure to work with improving your rating alternatively, and you may pay special attention for the borrowing application, DTI, and quantity of unlock profile you really have. Paying off obligations, getting in touch with financial institutions to have assistance, and to prevent the newest purchases have a tendency to all of the make you more appealing for a property equity mortgage.