Reforms you will definitely improve use of federally covered financial support for typically underserved communities

- Desk out of Content material

Overview

Us citizens struggle getting finance to shop for are built home: Assertion costs for these loans become more than seven minutes highest than for the individuals regularly buy equivalent web site-established (nonmanufactured) belongings. 1 Although not, investment pressures aren’t the same for everyone people. Studies have shown that loan providers refute are manufactured lenders so you’re able to Black people on somewhat high rates than it reject funds so you can Light individuals, effortlessly staying of many Black colored consumers from just one of your nation’s most reasonable paths so you can homeownership. dos

So it difference is due in part towards types of mortgage device candidates seek. Are created homebuyers whom currently own, otherwise are capital, the brand new property beneath their residence have been called landowners and have now multiple solutions while looking for are designed a home loan. They are able to sign up for home financing, and that cash both the are available household while the belongings beneath it, or your own property loan, and that cash the are available house only.

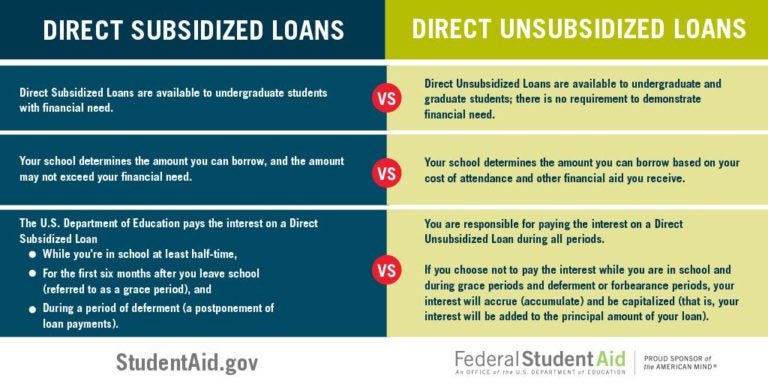

Lenders refuse software for personal possessions loans more often than it refute software getting mortgages-partly just like the particular mortgages are insured by Federal Homes Administration (FHA), and this reimburses loan providers whenever a debtor is unable to pay back an effective loan. Conversely, private property money almost never provides authorities support, because just government program built to insure such as for instance finance-brand new FHA’s Identity We program-could have been made outdated right down to outdated program statutes. (Mortgages and personal possessions funds one use up all your regulators insurance rates is identified because the conventional money.)

Even though personal possessions funds try declined more often than mortgage loans, research suggests that Black colored buyers are more more than likely than Light customers to apply for such finance. Sometimes, Black people might want to fool around with individual assets money as they do not have you desire or need to include in the borrowed funds this new home below their property. On top of that, either the fresh land isn’t really entitled to be taken because guarantee. Yet not, almost every other Black colored people is generally responding to the loan available options to them-which have pair lenders to pick from. Almost around three-fourths regarding Black are built homebuyers make an application for money from merely a few loan providers, who’re the country’s top issuers of personal possessions fund.

Policymakers looking to develop homeownership solutions for Black colored home must look into an effective way to improve level https://paydayloanalabama.com/madrid/ of Black are available home buyers which apply for FHA mortgages-and decrease the number whom apply for old-fashioned finance. To do this, the newest FHA would be to earnestly prompt major lenders giving a great deal more federally covered finance. Brand new company must develop its outreach efforts regarding Southeastern United states, where very Black are manufactured home buyers live-and you will in which pair are manufactured house loan providers give FHA financial support. step 3

At the same time, policymakers is seek to improve the means to access of individual possessions money to possess landowners whom choose otherwise you would like them. The FHA should renew the inactive Title I program, which was built to assistance individual possessions lending, by increasing the count which can be lent underneath the system; helping loan providers to reduce the costs that with automated underwriting solutions; and improving the latest program’s insurance coverage speed.

Drawn to each other, growing the newest FHA’s mortgage system and you will updating Term I would personally help solution the latest disparities Black colored individuals face when seeking are made home financing. Brand new Pew Charitable Trusts quotes you to such as changes will allow the latest FHA in order to twice Black applicants’ access to are made a mortgage while you are including merely minimally toward dangers borne from the agencies.

Black candidates rarely look for FHA mortgage loans regardless of the program’s higher recognition rates

Landowners (were created homebuyers just who own otherwise money the new homes underneath their home) have a tendency to get certainly one of about three variety of funding: a traditional home loan, a conventional personal assets mortgage, otherwise an enthusiastic FHA mortgage. With each other, these types of choices be the cause of 95% from home purchase software filed from the were created homebuyers between 2018 and you can 2022. 4 (Specific people submit an application for fund covered otherwise protected because of the Service of Pros Affairs or the Service off Farming, but these loans aren’t available to every buyers and you can compensate a tiny show of your investment field.)