If you are searching to shop for a created domestic, you’re thinking what kinds of fund can assist create your perfect away from homeownership possible.

Brand new Federal Homes Administration’s (FHA) mortgage brokers are an affordable option for people with challenging financial records. They may be able render people the fresh new promise and you can means to present roots because of their parents. Anyone is really worth a house they love, and you may FHA loans can assist you within the getting you to definitely purpose.

What is an enthusiastic FHA Are produced Financial?

This new FHA are a division of one’s Department out of Property and Urban Creativity (HUD). It is an agency one insures mortgages you to recognized loan providers material. These types of loans make homeownership reasonable by providing low-down repayments and you can acknowledging all the way down credit ratings than other options. These types of loan is of interest in order to reasonable-money people and you may very first-go out residents.

You can buy an FHA financial to own are designed belongings that have an excellent HUD Certification Identity that abides by certain regulations established by Are made Household Build and you can Safeguards Conditions (MHCSS).

How will you Rating an enthusiastic FHA Mortgage to own a produced House?

FHA are produced mortgage brokers are very the same as FHA loans to have conventional residential property. That being said, you’ll find special FHA possessions and you can design requirements getting the fresh new mortgage, and having to meet minimal home loan standards.

Minimum Mortgage Criteria having FHA Fund

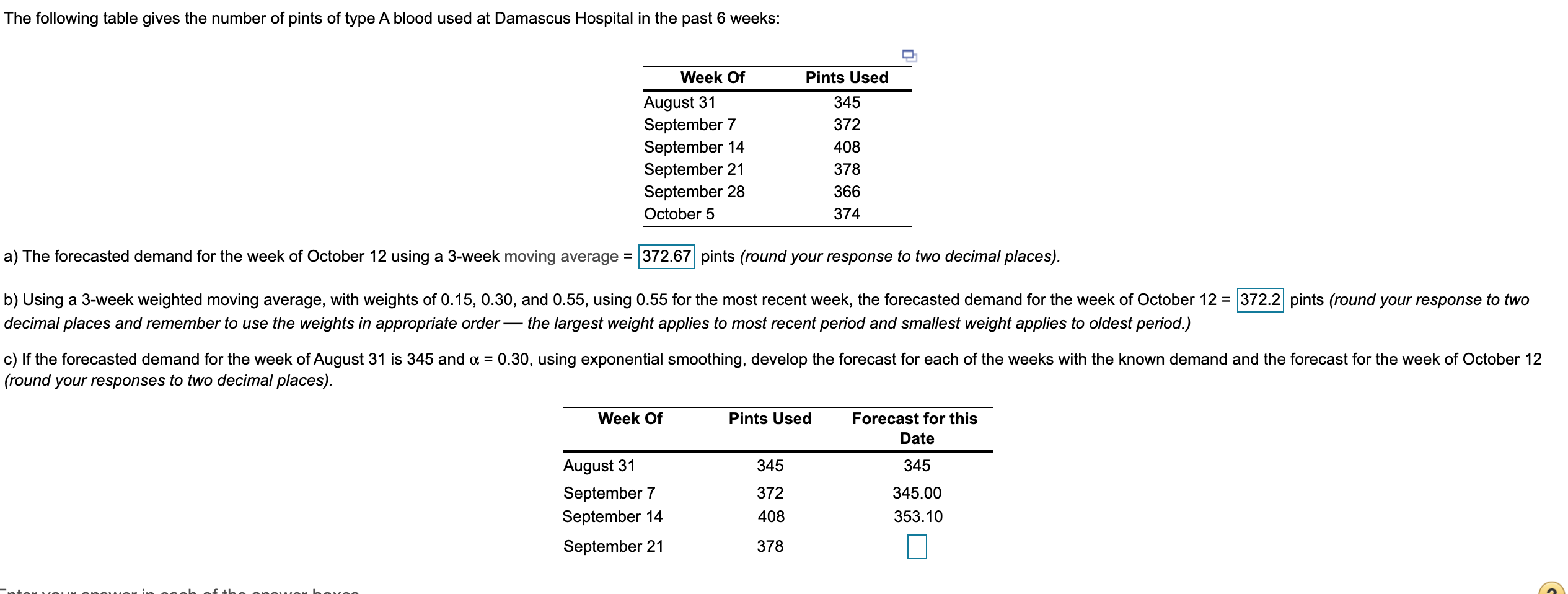

You should see particular requirements off FHA getting mortgage qualifications. Listed here are the minimum requirements when it comes to particular FHA mortgage:

- Credit history: Whenever you are FHA money are great for somebody in place of a perfect borrowing from the bank records, there are numerous direction based on how your rating has an effect on your own down payment. Individuals with good FICO get out-of 580 or even more get an excellent 3.5% downpayment program.

- Debt-to-income proportion: Your debt-to-income ratio must be lower than 43%.

- Financial advanced: FHA demands you to provides a home loan insurance premium (MIP).

- Proof of income: Due to the fact a buyer, you prefer both a steady stream of money and also to become capable confirm your own employment.

- Number 1 household: The home has to be brand new consumer’s top home in order to be considered for FHA funds.

Property Conditions to own FHA Are designed Home loans

With respect to FHA are created home guidelines, there are many requirements that assets you want towards the buying need to meet to become entitled to the loan.

- There needs to be use of sewer and you can h2o business.

- The home need categorize given that a house.

- You need to treat pulling hitches and you may powering gear.

- A prescription HUD secure should be apparent toward house’s external.

Construction Standards for FHA Are created Home loans

Discover special FHA are produced home conditions for brand new construction. If you intend towards to purchase such house with house, you could tend to mix the expenses having one transportation costs to possess the full loan amount. However, there are requirements off these funds and you will framework, including:

Advantages and disadvantages regarding FHA Money

If an FHA loan suits you relies on your own book financial situation. There loans Orange are one another advantages and disadvantages to that particular particular family loan.

Solutions so you’re able to FHA Are available Mortgage brokers

Proper whom qualifies getting 100% funding otherwise provides a really highest credit rating, there are other are produced financial alternatives that you could want to consider.

Would you Rating a keen FHA Loan getting a standard Home?

Yes! FHA standard home requirements have become like those of are made homes. Standard property should be dependent immediately following Summer 15, 1976, to help you meet the requirements. The home will have to meet all Design Manufactured House Installment Conditions and be forever linked to the lot. It will likewise need to have best liquid and you can sewage systems.

Finding Making an application for a made Mortgage?

Within CIS Home loans, we all know the value of providing anyone along the path of the fresh new American fantasy using reasonable homeownership.

All of our knowledgeable class can help you as a consequence of the easy app processes being have the mortgage option that is correct to you personally along with your house. All loans are susceptible to approved credit.