Usually, less DTI proportion is the better while obtaining a beneficial financial. Yet particular DTI conditions may vary according to the mortgage program and you can financial you’re having fun with so you’re able to secure financing for your house pick.

DTI standards getting FHA money

Yet it’s important to just remember that , not totally all lenders try ready to partner with consumers that highest DTI rates. Lenders is also lay their particular private requirements where DTI rates (or any other loan requirements) are worried.

Some lenders may accept FHA mortgage consumers with DTI rates due to the fact highest due to the fact 57%. Most other loan providers may set the fresh DTI restrictions to own borrowers from the a beneficial lower height-commonly as much as forty% rather.

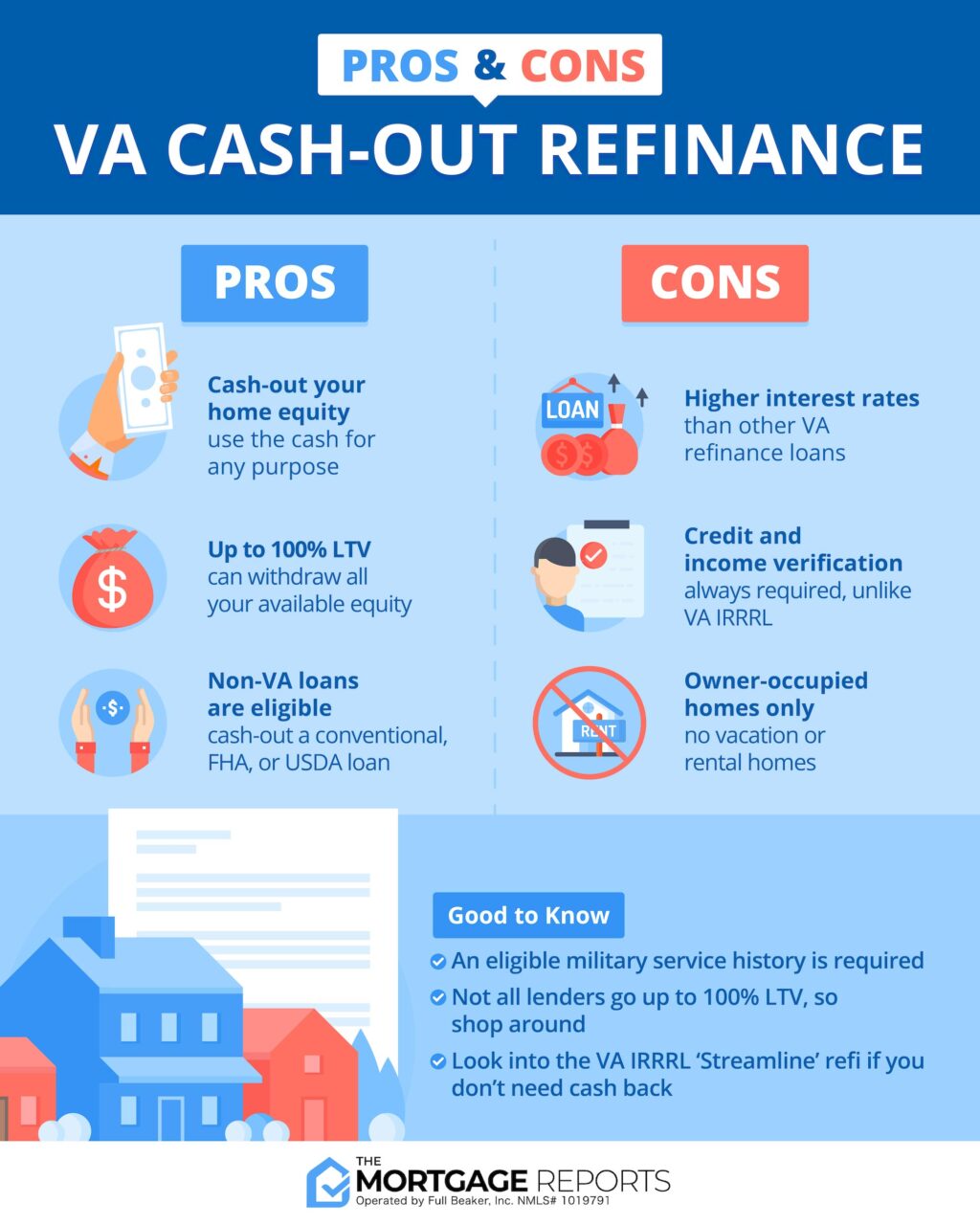

DTI requirements americash loans Colorado City to own Virtual assistant loans

Virtual assistant fund is going to be a fees-effective way to own qualified energetic-responsibility military service players, qualified experts, and enduring spouses becoming property owners. Besides do Virtual assistant fund provide eligible individuals the opportunity to purchase a house without deposit needs, Va loans likewise have so much more lenient DTI criteria weighed against almost every other kind of mortgages.

That have Virtual assistant funds, there’s no maximum DTI ratio limitation. But really private loan providers was liberated to set their guidance. You ought to talk to your own bank to see which DTI proportion criteria you really need to see for many who make an application for a great Va loan. And it’s really crucial that you feedback your allowance to ensure that you cannot overcommit on your own economically either.

DTI conditions to have USDA finance

USDA fund is another type of government-supported mortgage loan system getting reasonable- and average-earnings individuals who wish to pick house into the qualified outlying areas. As a whole, you want a beneficial DTI proportion out of 41% otherwise down becoming eligible for good USDA loan.

These reasonable financing plus feature no downpayment with no minimum credit score criteria. However, private loan providers often favor consumers getting a 620 FICO Score or more.

Ideas on how to change your DTI proportion

Reducing your debt-to-earnings ratio before applying getting home financing may change your likelihood of qualifying to own a mortgage (and obtaining a lowered rate of interest). Here are some tips that could make it easier to lower your DTI ratio.

- Lower obligations. Believe paying obligations just before your own home loan application if you can be able to do so. As you slow down the balances you borrowed to help you loan providers to your specific bills, for example playing cards, your own DTI proportion could possibly get lowering of reaction. In addition to, if you work with paying off credit card debt, you could potentially enjoy the added benefits away from improving your credit rating and you will saving cash on the bank card focus costs as well.

- Improve income. Getting additional money is yet another possible cure for replace your DTI ratio. But it’s crucial that you just remember that , this strategy might not be a magic pill where your mortgage software program is alarmed. Taking a boost at work could well be helpful if the workplace was ready to promote a letter proclaiming that the money raise are permanent. But when you pick up area-day work to earn more cash, possible typically you desire at least several years’ worth of taxation statements you to show you’ve been making that money each day before your financial often amount all of them to own DTI calculation purposes.

- Incorporate good cosigner or co-debtor. The fresh improvement here is if the other person have entry to the funds you are borrowing. If you don’t, they’re good cosigner. Once they would, they truly are a beneficial co-debtor. In any event, they might be agreeing to spend straight back the loan for those who default. Including an excellent cosigner otherwise co-borrower can get slow down the complete DTI proportion in your loan if they earn even more income and you may owe fewer expense than the you. And you can, if you find yourself using that have a spouse or partner, you’ll be able to decide to create these to the mortgage anyway. But be aware that in the event that a great cosigner’s DTI ratio are high than simply yours (or comparable), adding these to the program might not be since the of use just like the you’ll promise.